Stay informed with free updates

Simply register on the Inflation in the UK myFT Digest – delivered straight to your inbox.

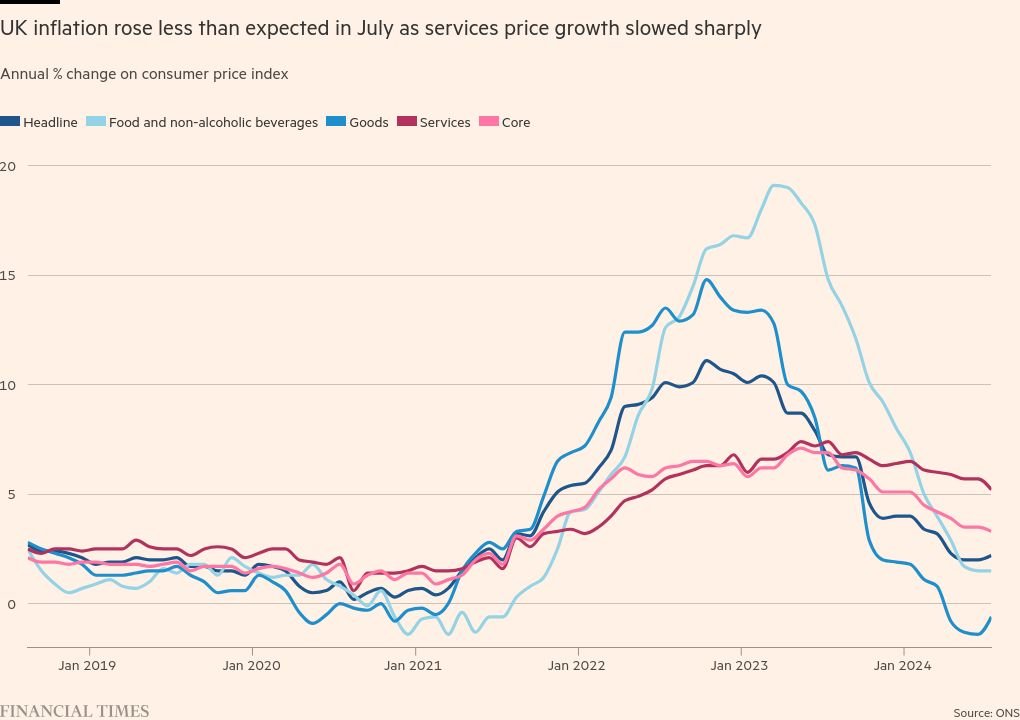

UK inflation rose less than expected to 2.2 percent in July as underlying price pressures fell sharply, opening the door to further interest rate cuts by the Bank of England this year.

The annual rise in consumer prices, reported by the Office for National Statistics on Wednesday, fell short of expectations for a 2.3 percent increase by economists polled by Reuters.

But the figure is still the first rise of the year and puts inflation above the Bank of England’s 2% target. In May, price growth slowed to 2% for the first time in three years and held steady in June.

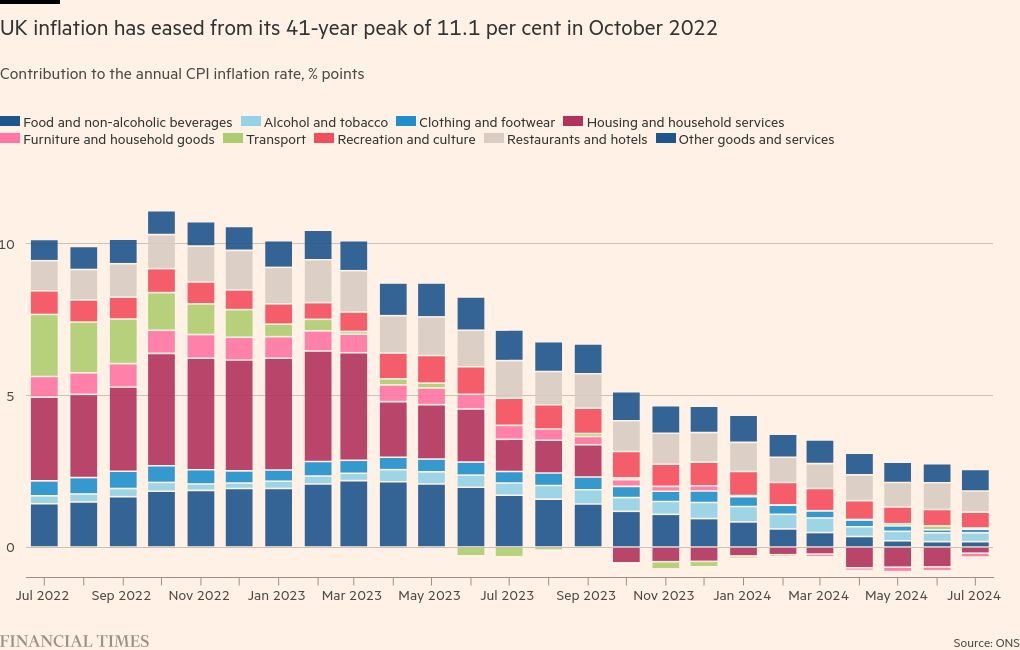

The central bank had expected inflation to rise to 2.4 percent due to a smaller fall in household energy bills, but slower growth in hotel costs helped lower the headline figure.

Services inflation, the BoE’s main measure of domestic price pressures, eased more than expected to 5.2 percent in July from 5.7 percent in June, the lowest level since June 2022. Analysts had expected a drop to 5.5 percent.

Ruth Gregory, an economist at consultancy Capital Economics, said the “smaller-than-expected rise” in consumer prices and “the sharp fall in services inflation” would “reassure the Bank of England… and open the door to further interest rate cuts later this year.”

Wednesday’s data comes after the BoE cut interest rates on August 1 for the first time since the start of the Covid-19 pandemic.

Annual core inflation, which excludes food and energy, fell to its lowest level since September 2021, at 3.3 percent in July, down from 3.5 percent in June.

The British pound fell slightly against the US dollar after the data was released, with the pound dipping 0.1 percent to $1.284.

UK government bonds rose, with the rate-sensitive two-year yield falling 0.04 percentage point to 3.56 percent, as investors increased their bets on two more BoE interest rate cuts before the end of the year.

Rob Wood, an economist at consultancy Pantheon Macroeconomics, said there was “no doubt” that the fall in services price growth supported BoE policymakers’ argument that “inflationary pressures are gradually easing, justifying further interest rate cuts”.

But he warned that the decline in services inflation had been driven in part by erratic airfare and hotel prices and said the Monetary Policy Committee was unlikely to cut rates again at its September meeting.

Annual growth in restaurant and hotel prices fell to 4.9 percent in July from 6.2 percent in June, the ONS said, and was the biggest drag on the overall rate.

The BoE expects UK inflation to rise slightly in the second half of this year but ease to 2.2 percent by the end of 2025, 1.7 percent in 2026 and then 1.5 percent in 2027.

Official data released on Tuesday showed annual wage growth excluding bonuses, a measure of underlying price pressures, slowed to its lowest level in almost two years, 5.4 percent.

After cutting the benchmark interest rate by a quarter point this month to 5 percent, BoE Governor Andrew Bailey said: “We need to ensure that inflation remains low and be careful not to cut interest rates too quickly or too much.”

Catherine Mann, an external member of the MPC, said this week that the UK should not be “lured” into thinking that the battle against inflation was over after a short-term fall in the headline rate.

The rise in inflation in July had been anticipated at the Treasury and was cited by Conservative officials as a minor factor in former prime minister Rishi Sunak’s decision to call a snap election.

For the Labour government, the small rise in inflation is a reminder of the challenges facing Chancellor Rachel Reeves, who wants to boost growth rates but knows the BoE will remain cautious about cutting interest rates further in the near term.

Responding to the inflation data, Darren Jones, chief secretary to the Treasury, said the government was “under no illusions about the scale of the challenge we have inherited”.

Shadow chancellor Jeremy Hunt said Reeves “should not use this data as an excuse to break his promises and raise taxes.”

In the eurozone, inflation rose to 2.6% in July from 2.5% in June. Later on Wednesday, other data is expected to show that annual inflation in the United States remained unchanged at 3% in July.

#inflation #rises #expected #July