Getty Images

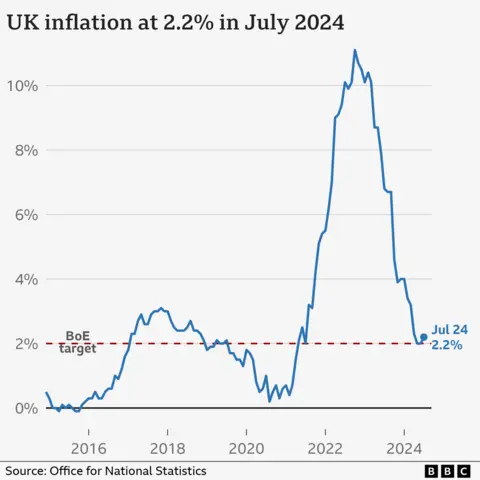

Getty ImagesThe UK inflation rate has risen for the first time this year, Official figures show.

Overall prices rose 2.2% in the year to July, slightly above the Bank of England’s 2% target, which had been in place since May.

The increase was expected, as gas and electricity prices fell less than a year earlier. The increase is also smaller than many economists had expected.

The latest figures mean prices are now rising faster across the UK than in previous months, but still at a slower pace than in 2022 and 2023, when households were hit particularly hard by rising energy and food bills.

The Bank of England expects inflation (which measures the rate at which prices rise) to rise to 2.75% in the coming months before falling below 2% next year.

Another set of inflation figures, as well as employment and wages data, are due to be released ahead of the next rate-setting meeting on September 19.

The bank had raised interest rates to combat rising inflation but last month cut them to 5% from 5.25%, the first reduction since the start of the pandemic.

Higher rates may be good for savers, but they can increase the cost of mortgages and other loans for consumers.

‘September cuts are not ruled out’

Experts have been predicting further cuts this year, and investors are now increasing their bets that the Bank will opt for a cut in September.

Sanjay Raja, chief UK economist at Deutsche Bank Research, said: “A rate cut in September should no longer be ruled out. And it’s entirely conceivable that we could see multiple more rate cuts this year.”

However, Debapratim De, head of economic research at Deloitte, said the latest figures were unlikely to “materially alter the Bank’s thinking on interest rates”.

The Bank also takes inflation in the services sector into account, for example, when deciding rates.

While prices in this sector slowed to 5.2% in July, this was partly attributed to airfares and hotel stays, which can be quite volatile.

Mr De added: “We expect rates to remain unchanged in September, but two more cuts are likely this year.”

Livia Marrocco runs a restaurant and ice cream parlour in Hove

Livia Marrocco runs a restaurant and ice cream parlour in HoveInterest rate cuts could be good news for businesses, which have been grappling with higher rates and rising inflation in recent years.

Livia Marrocco, owner of Marrocco’s restaurant and ice cream parlour in Hove, told the BBC: “Products have gone up in price. Ingredients have gone up. We have raised prices slightly.”

However, he said things have been improving recently as good weather and school holidays are attracting more customers.

Inflation rose to 11.1% in the wake of the war in Ukraine and pandemic-related supply chain restrictions, raising the cost of living for millions of people.

But it had been falling steadily until June, when the Bank of England raised interest rates to curb consumer demand.

Grant Fitzner, chief economist at the Office for National Statistics (ONS), said: “Inflation rose slightly in July as domestic energy costs fell by less than a year ago.

“This was partially offset by hotel costs, which fell in July after strong growth in June.”

Fitzner also told the BBC’s Today programme on Wednesday that price rises “under the hood” were kept under control, with services inflation falling in July and food prices unchanged.

“This still suggests that inflationary pressures, at least in the near term, are quite moderate,” he said.

According to the think tank Institute for Fiscal Studies, food and beverage prices rose by 28.4% between September 2021 and September 2023.

Its latest analysis suggested that poorer households saw their food bills rise much more than those on higher incomes, as the biggest price increases had been applied to cheaper brands.

But by July, food price inflation had stabilised at just 1.5%, according to the ONS.

Darren Jones, chief secretary to the Treasury, said the new Labour government was “under no illusions” about the challenges still facing households.

But shadow chancellor Jeremy Hunt said the new figures showed “more needs to be done to keep inflation down”.

How can I save money on my grocery shopping?

Look at your cupboards so you know what you already have.

Head to the discounts section first to see if they have anything you need.

Buy things close to their expiration date, which will be cheaper, and use your freezer.

Read more tips here

#inflation #rate #rises #increase #year