The monthly services CPI, which has been a strong shock, fell in July after positive readings in previous months. The basic goods CPI has performed well.

By Wolf Richter for WOLF STREET.

The sharp year-on-year slowdown in the core producer price index and services PPI in July was a one-off event, driven by the July 2023 services PPI (+9.9%), the highest monthly reading in over two years, which fell from the 12-month figure and was replaced by July 2024 (-1.9%), the lowest monthly reading since March 2023.

It will not be repeated for the rest of the year because all the remaining monthly figures that will deviate from the average during the next five months were low or negative. And the base effect that was a favorable factor in July will become an adverse factor in August and beyond.

And in terms of monthly figures (the blue lines in the charts below), well, they are very volatile.

On a monthly basis, the producer price index for final demand, which tracks inflation in the goods and services that businesses buy and ultimately try to pass on to their customers, slowed in July from June as the services PPI fell into negative territory, following positive readings in previous months. The finished goods PPI, which excludes food and energy products, accelerated on a monthly basis but remains at a healthy level.

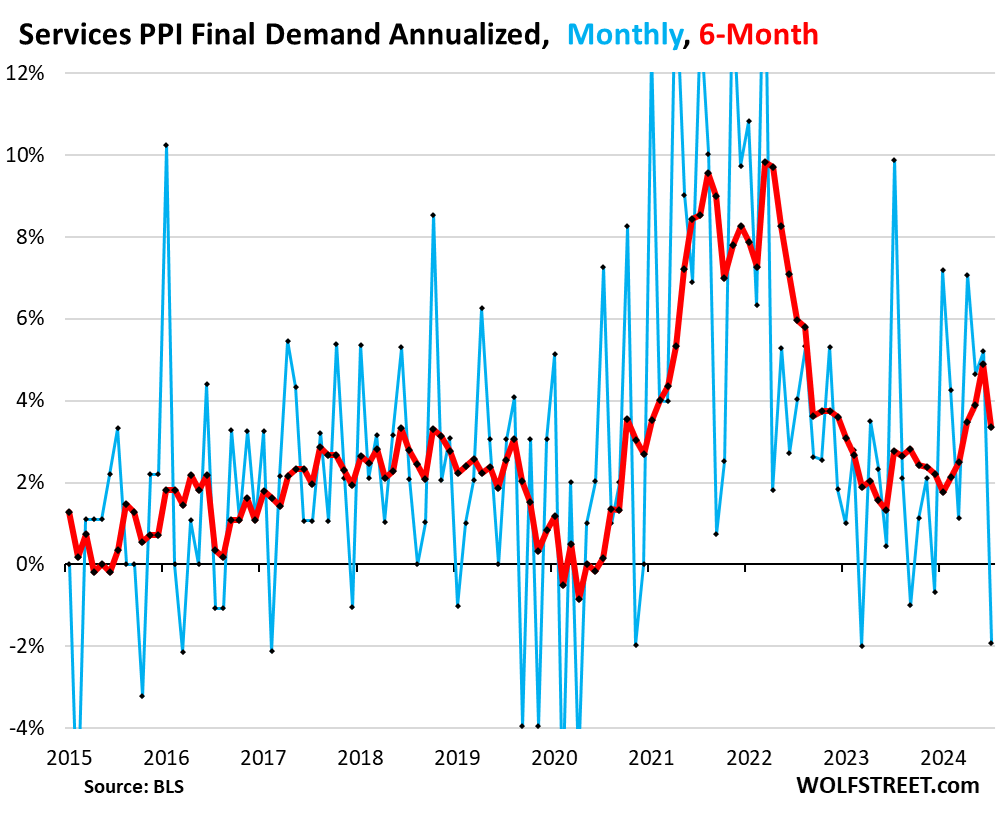

The CPI for services fell by a seasonally adjusted 1.9% annualized in July from June, after jumps of 5.2% in June, 4.7% in May and 7.1% in April, according to Bureau of Labor Statistics data today (blue in chart below).

The six-month average slowed to an annualized 3.4% in July, after rising at a blistering 4.9% pace in June, the highest level since August 2022 (red). The six-month rate removes some of the volatility from monthly readings and includes all revisions. It slowed so sharply because January’s 7.1% reading fell from the average and was replaced by July’s negative 1.9% reading.

Compared to the previous year, the PPI for services rose 2.6% in July, a marked slowdown from the 3.5% increase recorded in June.

The extreme base effect:The year-over-year reading fell so sharply because the abnormal +9.9% annualized month-over-month spike in July 2023 (the highest in over two years) was replaced by the -1.9% annualized drop in July 2024 (the lowest since March 2023). Going forward, last year’s low-to-negative month-over-month readings from August to December will move out of the 12-month base and be replaced by the forward readings, and the base-effect tailwind in July will turn into a headwind from August onwards.

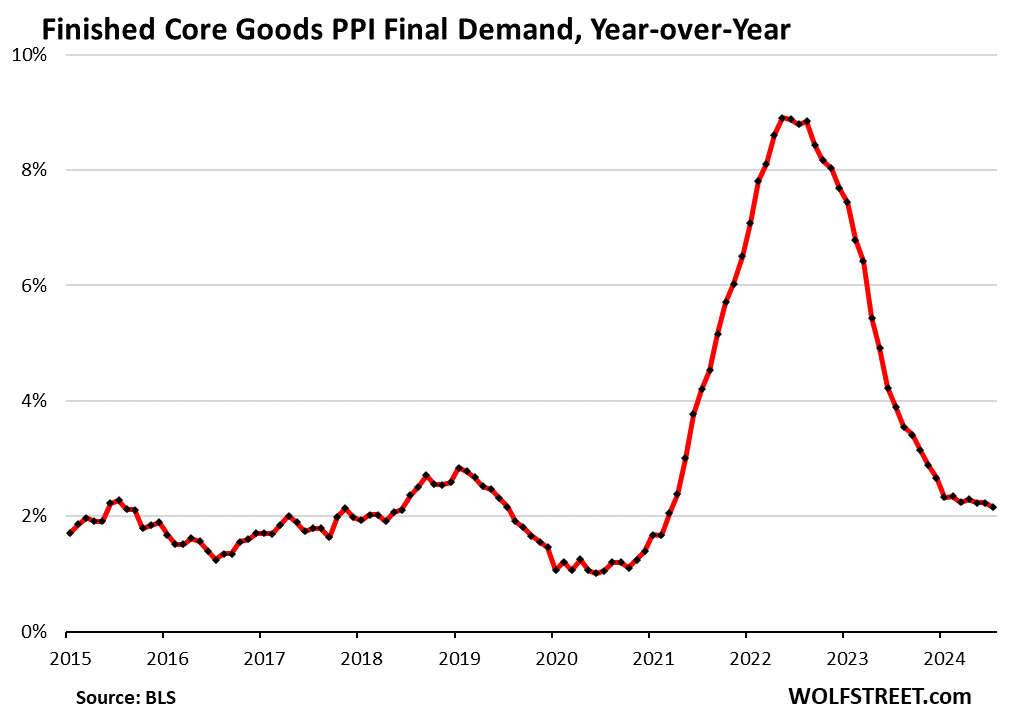

PPI for “finished basic goods” Price performance remains strong, but accelerated in July compared to June, rising by 1.6% on an annualized basis, compared to 0.8% in June. As we have seen overall, no significant inflationary pressures have built up in basic goods for over a year. Inflation has largely been eliminated from basic goods.

The half-year rate slowed to an annualized 2.3% from 2.7% as January’s 4.0% monthly jump fell outside the average and was replaced by July’s 1.6% increase.

The PPI for “finished basic goods” includes finished goods purchased by businesses, except food and energy. Prices have continued to rise, but at a pace that is within the normal pre-pandemic range.

Compared to the previous year, the PPI for finished basic goods has hovered around 2.2% throughout the year with a tiny downward trend that is lost in rounding; all of them are the lowest since March 2021. In July, the PPI for finished basic goods increased by 2.16%:

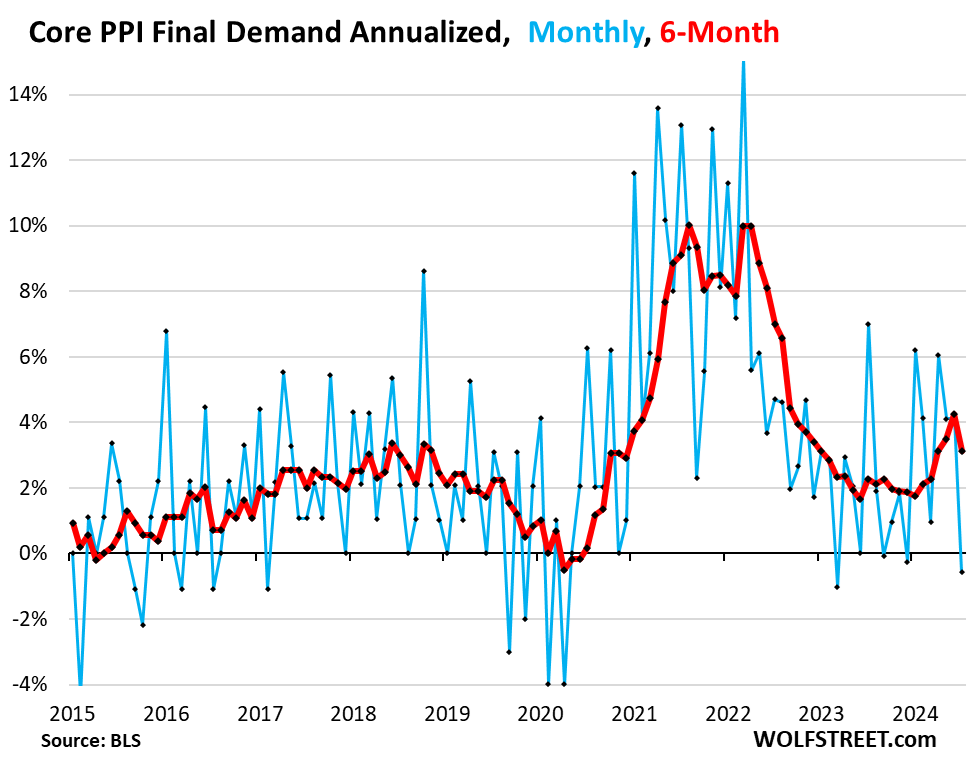

“Basic” IPP Core CPI fell by an annualized 0.6% in July from June, seasonally adjusted (in blue in the chart below), driven by the decline in services (-1.9%), which dominate the core CPI, and cushioned somewhat by the acceleration in finished goods (+1.6%). The annualized reading of -0.6% in July follows increases of 4.1% in June and May, and 6.1% in April.

The 6-month rate slowed to 3.1% in July from 4.2% in June, which had been the highest since September 2022. After performing well for much of 2023 near 2%, the 6-month rate took off again in February (red).

Core year-on-year PPI In July, GDP increased by an annualized 2.6%, a marked slowdown from June, driven by the base effect in services, as we noted earlier. June (+3.0%) had been the worst reading since April 2023.

For the remainder of the year, this year’s readings will replace the low to negative monthly readings from August through December 2023, with the tailwind from the large base effect in July turning into a headwind beginning in August.

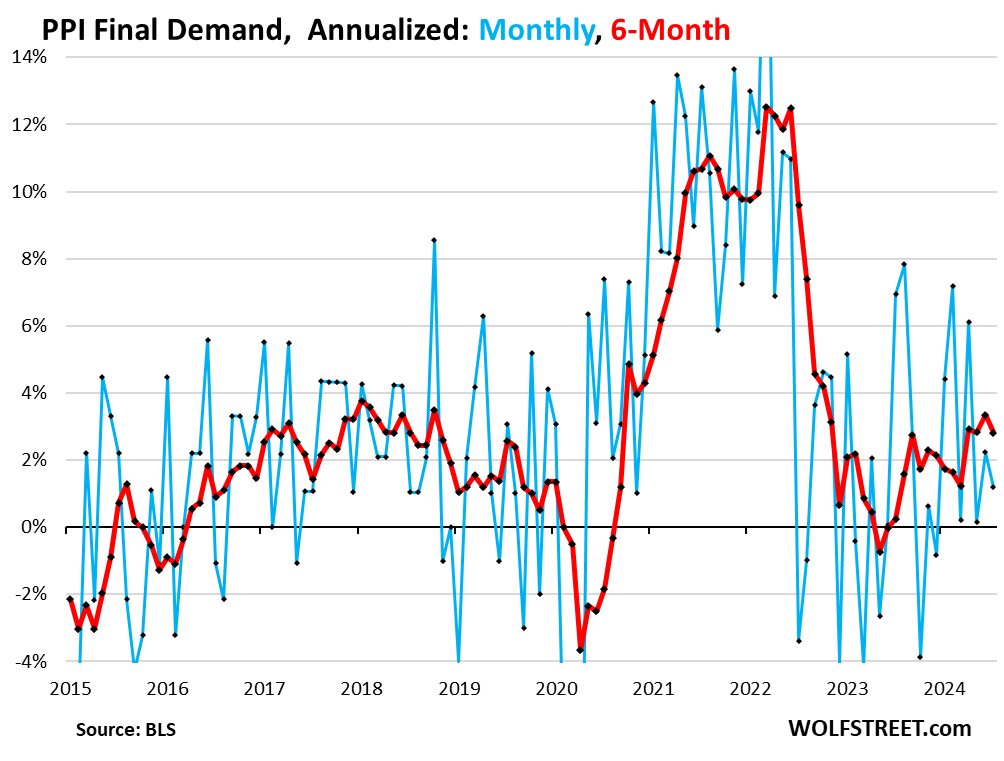

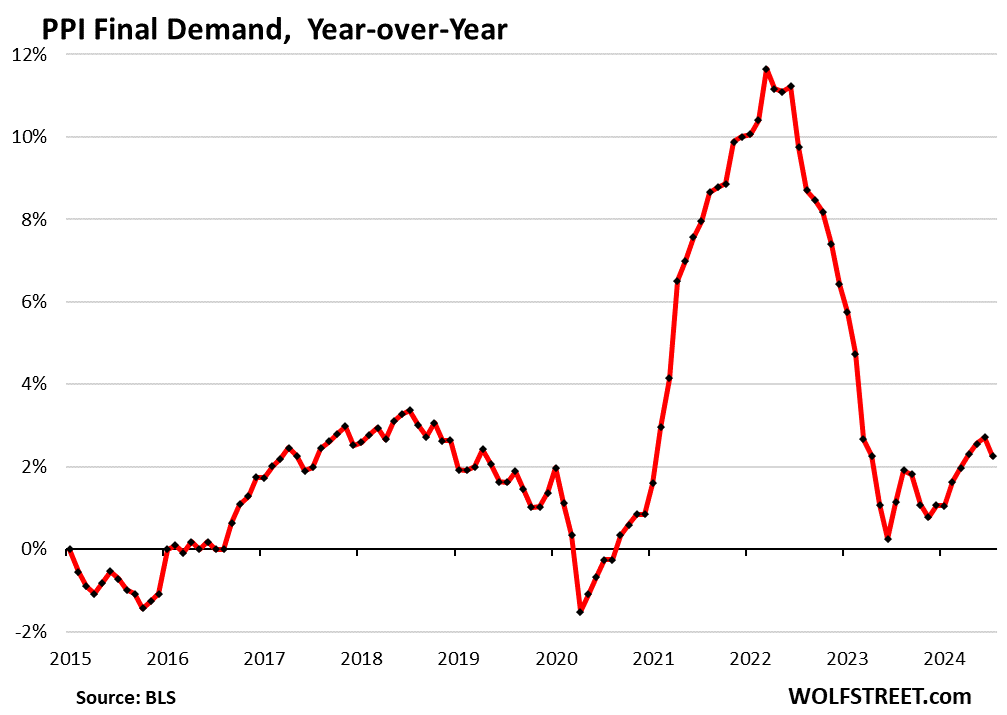

The overall PPI Final demand rose by an annualized 1.2% in July compared to June, a slowdown from June (2.2%). The year-on-year rate increased by 2.8%, a slowdown from 3.3% in June, which had been the highest since October 2022.

On a year-over-year basis, the headline PPI rose 2.2%, slowing from 2.7% in June, which had been the highest level since February 2023:

Do you enjoy reading WOLF STREET and want to support it? You can make a donation. I really appreciate it. Click on the beer and iced tea mug to find out how:

Would you like to be notified by email when WOLF STREET publishes a new article? Sign up here.

![]()

#services #PPI #core #PPI #yearonyear #pressured #downward #extreme #base #effect #reverse #month #rest