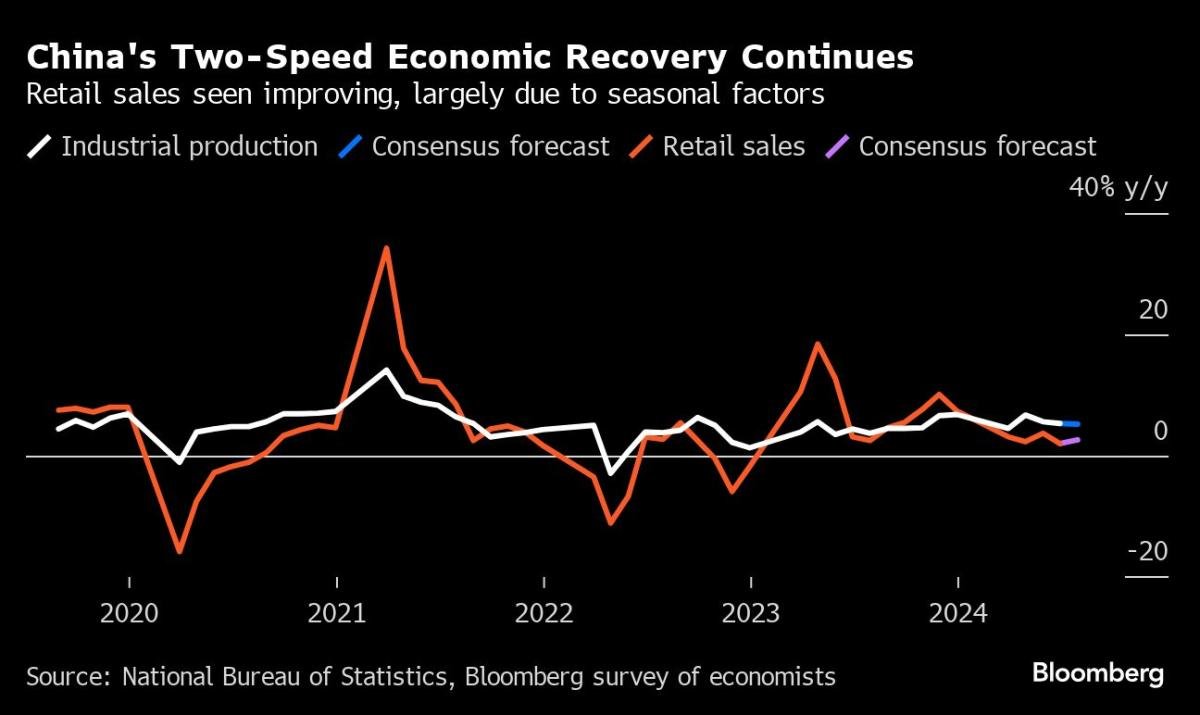

(Bloomberg) — China’s economy likely failed to emerge from its worst patch in five quarters, with an uneven recovery in July held back by consumer spending that still lags industrial activity and investment.

Most read on Bloomberg

Data due Thursday will show retail sales remained weak, according to the median forecast compiled by Bloomberg, despite a slight improvement thanks to a more favorable comparison base and the summer holiday season. Growth in the manufacturing sector and investment likely stagnated but continued to outpace consumption, which accounts for nearly half of gross domestic product.

“We expect the data to reflect a slow start to the third quarter,” Carlos Casanova, senior Asia economist at Union Bancaire Privee, said in a report this week. The weak inflation figures point to additional downside risks to the consumption outlook, he added.

The absence of a significant recovery in the economy is almost certain to intensify calls for additional stimulus in the remainder of this year as Beijing pursues its annual growth target of around 5%. China’s top leaders already signaled a more pro-growth stance at a recent Politburo meeting, promising to shift their focus to consumption, long the economy’s weak link.

What Bloomberg Economics says…

“China’s activity data for July will likely show that the recovery stalled at a crawl at the start of the third quarter, barely improving from June’s poor performance.”

— For a full analysis, click here

The central bank’s unexpected interest rate cut last month and a new initiative to boost spending on services have done little to improve consumer confidence, while the lingering housing crisis remains a drag on the people’s main store of wealth.

Although the government launched its largest bailout package for the real estate sector in May, it has not yet helped the market bottom out more quickly.

More monetary stimulus could soon be on the way. For now, the People’s Bank of China is set to hold the rate on its one-year policy loans, known as the medium-term lending facility, at 2.3% this month, according to all but one of 15 economists surveyed by Bloomberg.

The central bank has downplayed the role of the MLF as a key policy lever, opting instead for the short-term instrument of seven-day reverse repurchase agreements. It is planning to move the date on which it conducts its MLF operation to the 25th of each month, rather than the previous 15th, and the change could take effect as early as August, Bloomberg News reported earlier.

Here’s what to expect when the Office for National Statistics releases the data at 10am on Thursday:

Consumption

Retail sales rose 2.6% in July from a year earlier, according to economists surveyed by Bloomberg, compared with a 2% increase in June that was the slowest monthly rise since December 2022. That’s still far worse than the roughly 8% growth seen before the pandemic.

The reading likely benefited from a low comparison base last year, when consumers pulled back after an initial release of pent-up demand following the economy’s reopening from Covid lockdowns that kept everyone at home.

Travel, dining and leisure spending during the summer months is also likely to have boosted consumption. Residents are spending more quickly on services, although they remain thrifty and refrain from splurging on goods.

However, demand for durable goods was affected: car sales (which account for one-tenth of total retail sales) registered a decline in July.

“Weak retail sales growth underscores the country’s two-speed recovery: manufacturing leads economic growth while households remain hunkered down,” Moody’s Analytics economists wrote in a report last week.

Industrial production

Industrial output probably expanded 5.2% in July, down slightly from 5.3% in June. High temperatures and heavy rains may have reduced factory activity and suppressed demand.

And in another sign of growing weakness, the official manufacturing purchasing managers’ index indicated a third straight month of contraction in July, while a private survey of manufacturing PMI contracted for the first time in nine months.

Rising inventory levels at Chinese steel mills, coupled with weak production, also point to fragile demand. Orders from abroad moderated as falling prices weighed on export growth, which has been a bright spot in the economy so far this year.

Investment

Fixed-asset investment is forecast to rise 3.9% in the first seven months from a year earlier, unchanged from the January-June period. Real estate investment is likely to have declined 9.9% over the same period, narrowing slightly from the 10.1% loss recorded in the first six months.

The government is accelerating its bond sales, which are a major source of infrastructure financing, after issuance slowed in the first half of 2024 compared with the previous two years and slowed construction.

In May, the central bank launched a 300 billion yuan ($41.8 billion) cheap financing program to help local governments buy unsold apartments and convert them into subsidized housing. But take-up of the program was still low, indicating that policies aimed at turning the property market around face obstacles.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP

#Chinas #economy #moving #slowly #lack #consumer #stimulus