(Bloomberg) — European stocks look set to follow their Asian peers higher on bets that the next U.S. consumer price report will allow the Federal Reserve to begin easing policy in September.

Most read on Bloomberg

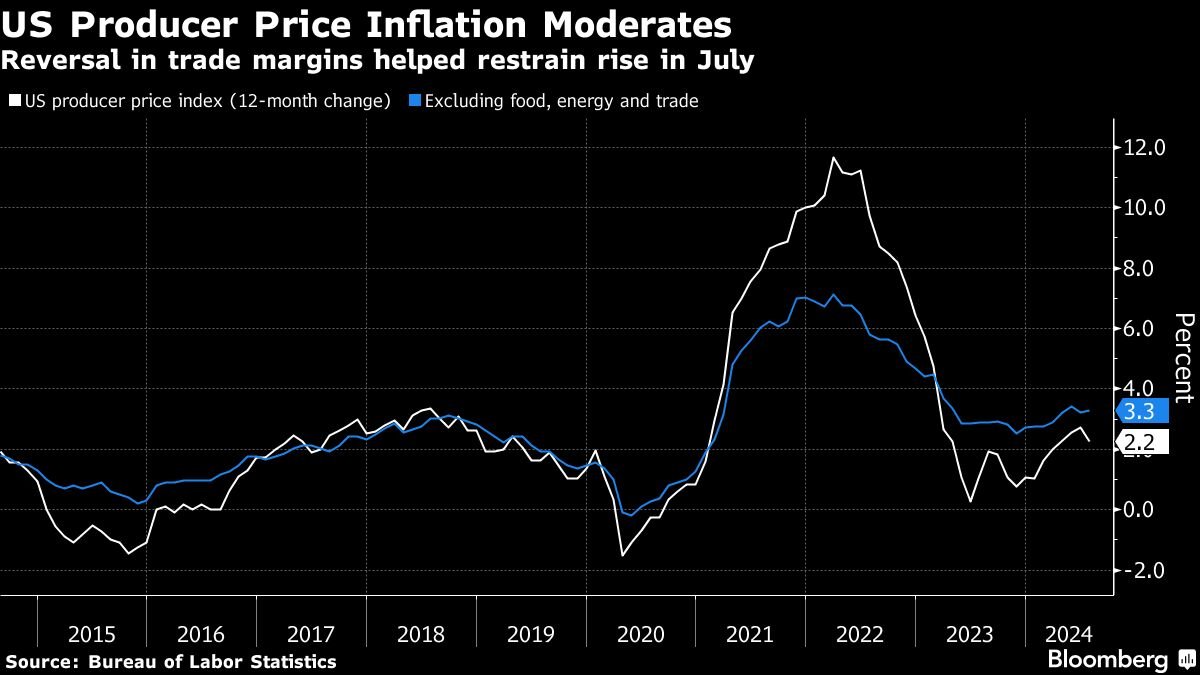

Euro Stoxx 50 futures rose 0.3%, while U.S. equity contracts traded little changed. MSCI’s benchmark index for Asian shares rose for a fourth session, recovering further from last week’s slump. The gains came after the U.S. producer price index rose less than expected, helping to fuel a 1.7% rally in the S&P 500.

Easing price pressures in the United States have bolstered confidence that policymakers can begin to cut borrowing costs and refocus on supporting the labor market. Analysts expect a modest 0.2% rise in both the consumer price index and the core gauge excluding food and energy in data due out on Wednesday, which would mark the smallest quarterly increase for the latter since early 2021.

“Global markets appear to be giving the all-clear signal after last week’s recession fears,” said Jun Rong Yeap, a strategist at IG Asia Pte. “The rise in US producer price inflation, which may be a precursor to further easing in consumer prices as well, has provided further impetus to the risk rally.”

New Zealand’s benchmark 10-year bond yields plunged after the central bank cut rates by 25 basis points, kicking off an easing cycle much earlier than previously indicated. The kiwi fell more than 1% while local stocks rose.

Treasuries were little changed after moving higher on the curve during the previous session, and positioning data showed traders remained optimistic. A Bloomberg gauge of the dollar held steady around a four-month low.

A recovery in risk sentiment and a weaker dollar supported Asian currencies. The Indonesian rupiah gained as much as 1%, while the Singapore dollar held near its high this year.

In Japan, the Nikkei fluctuated as traders digested news that Prime Minister Fumio Kishida will not run for a second term as leader of the long-ruling Liberal Democratic Party in September. The yen steadied after earlier strengthening toward the 146-per-dollar mark.

China’s profits

Elsewhere in Asia, Chinese stocks fell after data showed bank lending to the real economy contracted for the first time in 19 years. A gauge of Chinese technology companies in Hong Kong fell more than 1% ahead of results from Tencent Holdings Ltd. and its buyback plans.

“Chinese internet giants reporting earnings this week will be critical to whether weak consumer spending in China weighs on margins and ROI, and which vertical subsegments such as gaming may be the bright spot,” said Britney Lam, head of long-short equity at Magellan Investments Holding Ltd. “Valuation is attractive, but earnings momentum is key.”

The S&P 500 posted its biggest four-day rally this year overnight. The Nasdaq 100 rose 2.5%.

Wall Street’s favorite volatility gauge, the VIX, fell to around 18. Swap traders had priced in a Fed cut of around 40 basis points in September and a total rate reduction of more than 105 basis points by 2024.

In the corporate world, UBS Group AG posted stronger-than-expected second-quarter profit, bolstering Chief Executive Sergio Ermotti’s efforts to return capital to shareholders and finalize the integration of Credit Suisse.

Oil rose in Asian trading, recovering from Tuesday’s losses, after an industry report pointed to a sharp drop in U.S. crude stocks and heightened tensions in the Middle East. Gold fell.

Key events of this week:

-

Eurozone GDP, industrial production, Wednesday

-

US CPI, Wednesday

-

China housing prices, retail sales and industrial production on Thursday

-

U.S. initial jobless claims, retail sales and industrial production, Thursday

-

Alberto Musalem and Patrick Harker of the Federal Reserve speak on Thursday

-

U.S. housing starts, University of Michigan consumer confidence, Friday

-

Federal Reserve’s Austan Goolsbee speaks on Friday

Some of the main movements in the markets:

Stocks

-

S&P 500 futures were little changed at 2:10 p.m. Tokyo time.

-

Nasdaq 100 futures were little changed

-

Japan’s Topix index rose 0.4%

-

Australia’s S&P/ASX 200 index rose 0.4%

-

Hong Kong’s Hang Seng fell 0.5%

-

The Shanghai Composite fell 0.4%

-

Euro Stoxx 50 futures up 0.3%

Coins

-

Bloomberg Dollar Spot Index little changed

-

The euro remained virtually unchanged at $1.0994.

-

The Japanese yen was virtually unchanged at 146.82 per dollar.

-

The offshore yuan was unchanged at 7.1469 per dollar.

Cryptocurrencies

-

Bitcoin rose 0.6% to $60,957.07

-

Ether rose 0.9% to $2,724.03

Captivity

Raw materials

-

West Texas Intermediate crude rose 0.6% to $78.84 a barrel

-

Spot gold fell 0.1% to $2,461.90 an ounce

This story was produced with assistance from Bloomberg Automation.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP

#Stocks #rise #ahead #CPI #data #Zealand #dollar #plummets #Markets #roundup