Zepto has closed a $340 million round that boosts its valuation to $5 billion, up from $3.6 billion in June and $1.4 billion in August, as the startup races to gain market share in India’s competitive fast-track commerce market.

General Catalyst and Mars Growth Capital are jointly leading the Series G round, which will complete all its formalities within a few days, according to people familiar with the matter. The round gives Zepto, which gives customers access to a range of categories from groceries to electronics that they can receive in minutes, a valuation of $4.6 billion pre-money — or about $5 billion after funding, according to a term sheet seen by TechCrunch.

The new round means three-year-old Zepto is closing in on $1 billion in new funding this year.

Zepto competes with Zomato-owned BlinkIt and Swiggy’s Instamart in India’s growing express commerce market, which is starting to take market share from traditional e-commerce giants.

Zepto is on track to do more than $1.5 billion in annual sales, according to a source familiar with the matter. BlinkIt currently has an annualized GMV of about $2 billion. The fast-commerce companies, which started operating just three years ago, will have combined annual sales of $4.5 billion to $5 billion in India this year, compared with Amazon India’s $18 billion. Amazon has been operating in India for about 10 years and has invested more than $7 billion in its e-commerce business in the country.

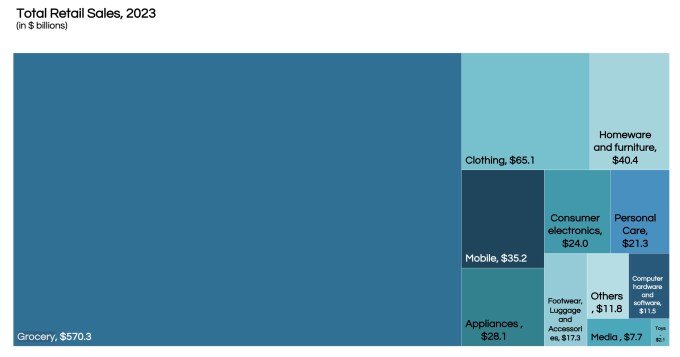

Retail is a $1.1 trillion market in India, but much of it remains untapped. Reliance Retail, which operates the country’s largest retail chain, is valued at about $100 billion. “That’s why every time a new model shows a hint of traction in Indian retail, investors reward it handsomely,” one investor told TechCrunch.

Indian newspaper Economic Times was the first to report on Mars Growth’s participation in Zepto’s new round. The Information previously reported that General Catalyst was collaborating with Zepto.

These fast-trading companies have set up numerous discreet warehouses, known as “dark stores,” across urban India. By strategically locating these facilities within a few kilometers of high-demand residential and commercial areas, they are able to fulfill orders within minutes of purchase.

The growth of fast-growing e-commerce companies in India, a $4 trillion economy, has surprised many investors and analysts, especially as many similar business models have collapsed in other markets. This rapid expansion has also surprised some established e-commerce players, with analysts suggesting that companies like Amazon have been slow to adapt to changing consumer habits in India.

Amazon has not been “strategic” enough. And the founders, be it Deepinder (Zomato), Aadit (Zepto), Vidit (Meesho) or the Flipkart team, have outperformed the management team. [of Amazon]“,” Bernstein analyst Rahul Malhotra told TechCrunch this month. Flipkart recently launched its fast commerce offering in parts of Bangalore.

Zepto aims to expand its dark store network to more than 700 by March 2025. The startup, which also counts Nexus, Lightspeed, Avra and StepStone among its backers, said in June that its revenue had increased 140% from the previous year. It works with more than 50,000 delivery partners and is adding more than 5,000 delivery partners every month.

Zepto previously said about 75% of its dark stores had positive EBITDA last month. Improved efficiency and scale mean a dark store that previously took 23 months to achieve profitability now reaches that milestone in six months, Zepto said in June.

Zepto currently operates in major cities across India and plans to expand to select smaller cities in the coming months.

According to Goldman Sachs, the total potential market in food and non-food categories for fast-food companies in the top 40-50 cities is approximately $150 billion.

#Zepto #hits #billion #valuation #fastmoving #commerce #heats #India #TechCrunch